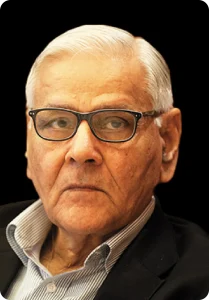

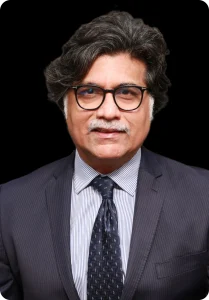

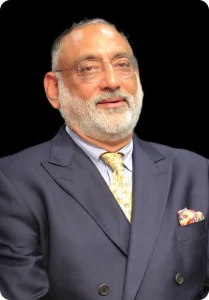

New Delhi, Oct 15 (IANS) Despite aggressively deleveraging the balance sheet to the tune of Rs 1,40,000 crore through monetisation of several key assets, the existing businesses of Essar Group in the sectors of energy, infrastructure, metals & mining, services and technology, have a combined revenue of $13 billion, or almost Rs 100,000 crore, said Essar Capital Director Prashant Ruia.

“We still have a fairly substantial portfolio of assets and companies. So in all, we are currently doing a turnover of about $12 billion-$13 billion, and we certainly see significant potential value in these sectors,” Ruia said in an internal chat put on the group”s website.

As part of its deleveraging exercised aimed at reducing huge debt on its balance sheet, Essar Group has already monetised its oil assets by selling Essar Oil to Rosneft and Trafigura (for a valuation of $12.9 billion). Besides, it has exited from the BPO operations Aegis and done a few other asset monetisation deals.

“In the oil & gas business, we have a refinery in the UK, with 16 per cent market share in the country. We have also entered the UK retail market and are building a national footprint of retail outlets. In infrastructure, we are India”s second largest port company. Our port capacity in India is currently, if I am not wrong, about 13 or 14 per cent of China, so there is a huge potential. India has a vast coastline and a huge potential to provide port services. Essar currently has about 110 MT of capacity but can grow manifold in this sector. So if you look at this portfolio and all, we still think there”s a lot of growth and lot of potential coming out of existing companies,” said Ruia.

Going ahead, the group is looking to grow operations in new economy areas; in technology and services. While the company already has build capacity in this area, new avenues for growth would be identified that could help scaling operations with limited capex.

“We are obviously going to look at growth in new sectors, especially the more unregulated ones, which are part of the new economy and which the market perceives differently or as more valuable than some of the more traditional core sectors,” Ruia said.

The new investment cycle would start after the company completes its deleveraging exercise. Essar has already paid off Rs 1.4 lakh crore debt and intends to clear the residual 10-15 per cent in the next two quarters.

“I think we did it (deleveraging) at the right time because we would have struggled to do so much in the current environment. The premium value that each of our investments fetched is a testament of the quality of the assets we have built and the technology utilised. In fact, the way these projects were conceived was clearly right because they attracted the best value even during a difficult market,” Ruia added.

Optimistic about India”s growth story particularly after a series of steps that the Finance Minister Nirmala Sitaraman announced, Ruia said the changes in the government policies in the last few years have addressed many of the regulatory uncertainties and this would ensure that new investments coming in would not have to face the same kind of risks that some of the old investment had suffered. He asserted that this coupled with domestic demand “still provides for a strong investment rationale to reinvest and grow”.

Source: Outlook India