HIGHLIGHTS

– Current energy prices well-suited to both producers, consumers

– Eyes on new upstream blocks offered by the government

– Accelerating capex spending due to attractive investment climate

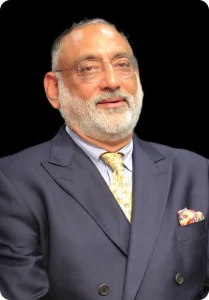

The S&P Global Commodity Insights India CEO Series is a compilation of exclusive interviews by Asia Energy Editor Sambit Mohanty with top government and industry leaders in India’s oil and gas sector. Get insights on how those companies are planning to strike a balance between traditional and new businesses at a time when energy transition is changing the industry’s landscape, while geopolitical turbulence is throwing up new challenges.

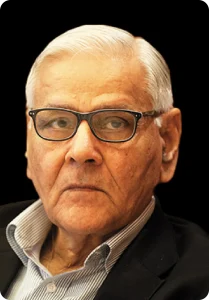

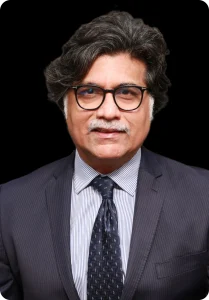

Essar Oil & Gas Exploration and Production Ltd. is accelerating capital expenditure plans to pursue exploration of unconventional hydrocarbons at its flagship eastern India block, as well as eyeing new blocks amid an improved upstream investment climate, CEO Pankaj Kalra told S&P Global Commodity Insights in an exclusive interview.

Global energy price levels are well-suited for both producers and consumers of oil and gas currently and a lack of upstream investments now would mean the opportunity to tap these opportunities in the fossil fuel segment would increasingly close amid a changing energy landscape, Kalra said.

Essar, which has already invested around Indian Rupees 50 billion ($610 million) developing its flagship Raniganj block, is looking to invest another Rupees 20 billion over the next 18 months on the back of relatively high current global oil and gas prices — which would make any potential upstream investment commercially attractive, he added.

“Our key focus is the block in eastern India where we are seeing a lot of good results but we will be looking at other blocks offered by the government,” Kalra said. “Some of the policy reforms are quite encouraging to spread our wings to other parts of the country. Our teams are evaluating those models to gauge their technical suitability,” Kalra added.

Essar, focusing on the upstream sector, was carved out by the owners of Essar Group after they sold Essar Oil — which mainly comprised downstream and retail oil operations — to a consortium comprising of Rosneft, Trafigura and United Capital Partners for $12.9 billion.

Main producing blocks

Essar now owns Raniganj in West Bengal as well as the Mehsana block in Rajasthan. The upstream producer has also received environmental clearance for exploring shale gas reserves in its Raniganj block after New Delhi overhauled its exploration policy and decided to allow operators freedom to explore both conventional and non-conventional sources, such as coalbed methane and shale reserves, within exploration acreage.

Kalra said that Essar currently has a market share of 65% of total CBM production in India and was committed to actively contributing to India’s vision of becoming a gas-based economy, under which New Delhi aims to raise the share of gas in the energy mix from the current 6% to 15% by 2030.

The company, which has been pursuing E&P activity for CBM for the past 25 years, has about 12 Tcf of resources in place — comprising about 4 Tcf of CBM and 8 Tcf of shale — at Raniganj East Block, Kalra said.

“We have produced over 80 Bcf of CBM until now. We are now working on more than 350 wells. There are 200 additional CBM wells in the pipeline over the next 18-24 months on which work will be done with additional investments,” Kalra said.

Essar said the company would strive to contribute about 5% to India’s total gas production over the next five years.

Following the announcement of a series of investor-friendly upstream policies, India’s upstream sector is now increasingly attracting interest from many private players, Kalra said.

“The government has moved away from a cost-sharing to a revenue-sharing mechanism. It really helps to expedite approvals. And now with the recent pricing and marketing freedom given to upstream operators, the environment for attracting investment is all set,” he added.

The oil ministry last June said India would allow operators to sell locally-produced crude in the domestic market without restrictions. Under the previous policy, the operator of a field could not directly sell locally-produced crude into the market and needed government permission for any sale of crude and condensate within the country. But under the new policy, the government would cease its function of allocating domestic crude and condensate output.

Asia’s recovery

Kalra said the sustained recovery in Asian oil and gas demand is a sign the worst of the pandemic’s impact on the industry is over, creating opportunities for the region’s upstream sector to rebound strongly. He added that the Asian market is the major driver of global energy dynamics, with about 40% share in global energy consumption and primarily oil-and gas-centric.

“During the recent geopolitical conflict and market turbulence we saw prices going through the roof, but now prices have come back to realistic levels for any developments to happen. We think prices will remain supportive for investments in the foreseeable future,” Kalra said.

S&P Global expects Dated Brent prices to average $85.50/b in 2023 and lower at around $84/b in 2024. The gas market, on the other hand, will be well supplied in 2023 as production growth outpaces demand, yielding an annual average Henry Hub price of approximately $2.80/MMBtu.

Kalra said the surge in energy prices over the past couple of years was a wakeup call for the oil and gas industry to know that not enough investment was flowing in to boost production.

“The demand outlook for oil and gas will remain robust for quite some time to come. Therefore, it is very important that investments keep flowing into that sector despite the increased push towards energy transition,” Kalra added.