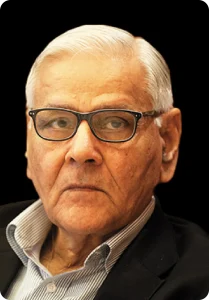

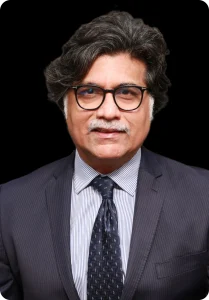

The Essar group is investing billions of dollars in energy transition in the UK and India, and manufacturing green steel in Saudi Arabia. PRASHANT RUIA, Director, Essar Capital (the investment manager of Essar Global Fund), is traveling to the World Economic Forum summit in Davos. He tells Dev Chatterjee in an email interview that international investors are positive on India. Edited excerpts:

What is the mood in your group as you travel to Davos this year? What investment plans will you showcase to investors at Davos?

It is a coincidence that Essar’s mood exactly resonates with the “Rebuilding Trust” theme of Davos. With ESG (environmental, social, and governance), sustainability and climate action becoming absolutely critical, traditional brickand- mortar companies will have to go the extra mile to align with the sensitivities of investors, governments, and communities. Having recently resurged from a challenging phase, Essar’s situation is no different. We are entering a phase where we are concentrating our energies on not just building green assets and industry ecosystems, but also robust governance systems. We are going to Davos with a positive attitude and a mood that reflects the excitement of creating new horizons for the industry.

What is the update on the group’s investment in energy transition? What is the progress on the Saudi steel plant? Will you meet investors at Davos?

We are making significant advances in energy transition, focusing on hydrogen, green mobility, and green steel ecosystems. In the UK and India, Essar Energy Transition plans to invest $3.6 billion (about Rs 28,800 crore) on hydrogen production, refinery decarbonisation, carbon capture, and green fuel storage, among other things. Our green mobility solutions focus on reducing carbon emissions in India’s logistics sector. In green steel, Essar is investing in a four million-tonne integrated steel plant in Ras Al-Khair, Saudi Arabia.

Do you think India has become a favoured destination of global investors and a hot topic for discussion at Davos?

India has emerged as a preferred investment destination for global investors, with political stability playing a pivotal role, particularly under the leadership of Prime Minister Narendra Modi. His governance, exemplified by the success of Gujarat, has instilled confidence in investors. This stability, combined with an expansive market, ongoing economic reforms, an improved business environment, and a skilled workforce has further strengthened India’s appeal as an attractive and reliable investment hub on the global stage.

While global events like the Israel-Hamas war and the Ukraine conflict may impact growth in a globalised setup, India’s delicate political posturing and robust domestic demand are expected to help maintain stable economic parameters.

What is your biggest worry as an entrepreneur from India?

My biggest concerns revolve around the availability of large-scale domestic risk capital in the economy. With climate change being a critical issue, we need sectors and industries to pioneer, invent, and innovate to transition to sustainable business models. While this comes with a fair share of risk, such investments are necessary, and access to risk capital becomes essential. It also fosters business growth and helps navigate uncertainties in a dynamic global and geopolitical scenario. A supportive banking sector is crucial for providing financial resources and tailored services that can contribute to the success and sustainability of entrepreneurial ventures. Addressing these concerns will foster a conducive environment for entrepreneurship in India.

The Indian Budget will be announced in the next few days. What are your expectations?

Keeping in mind the geopolitical situation, the focus of the Union Budget must be on bringing further stability to the Indian economy. With strengthened regulatory mechanisms, the budget must empower banks to fund development projects and encourage capital expenditure. Any economy can be fortified against external factors if robust private consumption is maintained, thereby triggering domestic demand. Hence, this Budget should be about enhancing the liquidity and financial strength of the common man.

Source: Business Standard